Nassau Income Accelerator

Product Overview

Snapshot

Portfolio Position

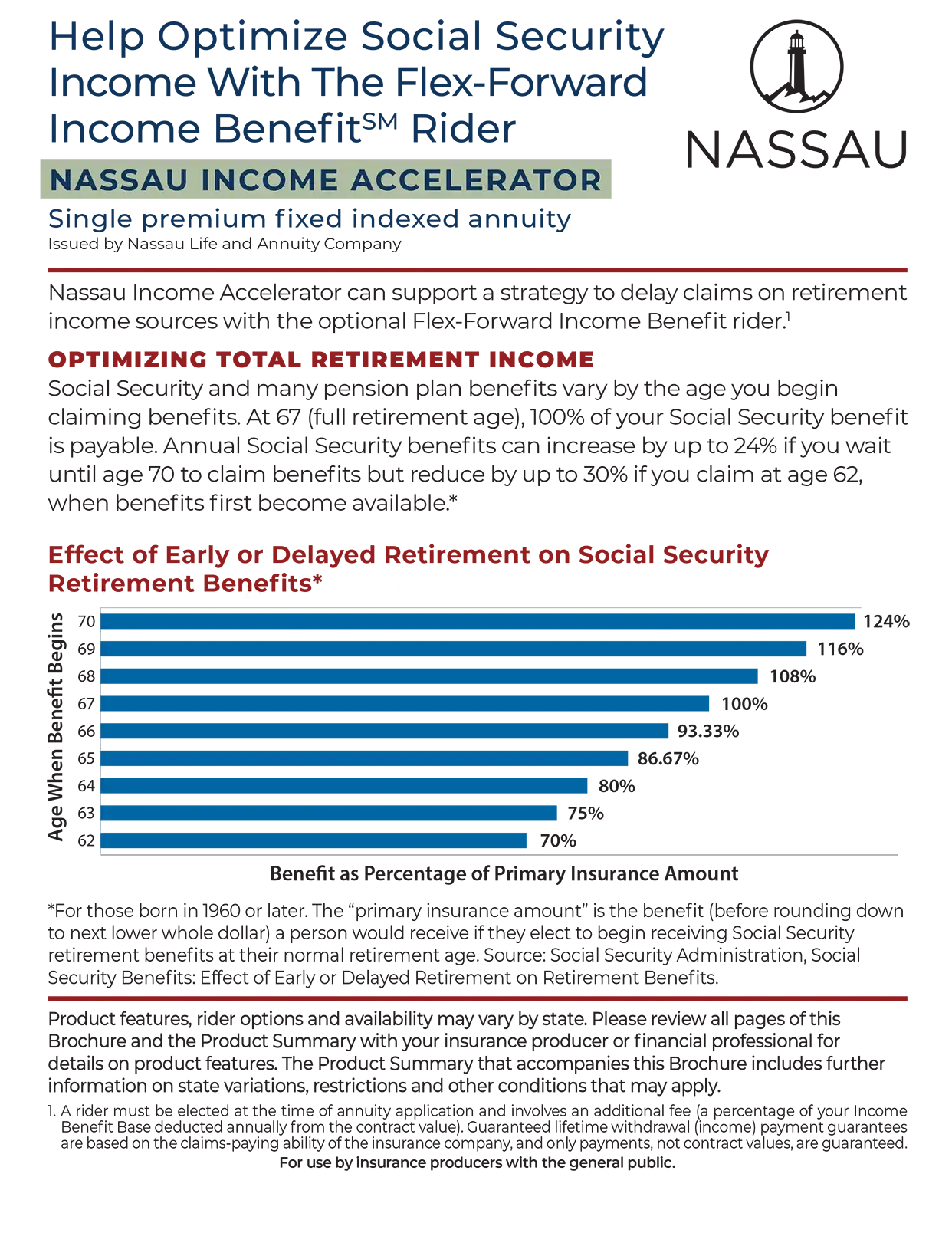

Nassau Income Accelerator offers our most flexible guaranteed income options and can help your clients optimize when they take Social Security, government or pension payouts.*

Consumer Description

Nassau Income Accelerator is a single-premium fixed indexed annuity that provides guaranteed income for life via a choice of three guaranteed minimum withdrawal benefit riders. It offers principal protection, a 10-year surrender charge period (9 years in CA), a 10% annual free withdrawal, a fixed account as well as 13 indexed account options to capture the positive performance of market indices.

Riders

This product requires the client to choose from one of three riders: Flex-Forward Income BenefitSM, Income Horizon: Early and Income Horizon: Later. All three riders include a 10% benefit base bonus. Additionally, each year, 10% simple interest roll ups occur to the benefit base for up to 10 years or until rider exercise, whichever comes first. Flex-Forward Income Benefit can help provide an income bridge before starting payments from sources such as Social Security, government or pension payouts to meet your client’s specific income needs by offering higher income payments early in exchange for lower income payments later. Income Horizon: Early and Income Horizon: Later both provide levelized guaranteed lifetime income to fit your client’s unique income timeline. All riders have an additional annual fee equal to 0.95% of the Income Benefit Base.

The Flex-Forward Income Benefit is available to issue ages 50-70 of youngest covered person and must be exercised prior to age 71 to be eligible for the Early Income Feature (see product materials for details).

*Nassau Life and Annuity Company, the Nassau Income Accelerator Annuity and the Nassau Flex-Forward Income Benefit rider are NOT connected with, recommended, or endorsed by any governmental program, agency, or entity, including the Social Security Administration.

Marketing Materials

Producer and Consumer Videos

Showing 1 of 6:

What Check Can We Write For Your Client in Retirement?

Supplement your client's retirement income using Nassau Income Accelerator

Start My QuoteA Powerful Social Security Optimizer Tool

![]()

Help identify clients' optimal Social Security filing strategies with LifeYield Social Security+, an online tool available to Nassau-appointed producers.

Important Disclosures

We reserve the right to revise declared rates at any time.

For Producer Use Only. Not for distribution to the public.

Product features, rider options, and availability may vary by state. Riders unavailable to Covered Persons under age 50 in Maryland. Product sales must be appropriate based on a comprehensive evaluation of the customer's financial situation, needs, and objectives. Guarantees are based on the claims-paying ability of the issuing company. Nassau does not provide financial, investment or tax advice or act as a fiduciary in the sale or service of its products.

Annuities are long-term products particularly suitable for retirement assets. Annuities held within qualified plans do not provide any additional tax benefit. Early withdrawals may be subject to surrender charges. Withdrawals are subject to ordinary income tax, and if taken prior to age 59½, a 10% IRS penalty may also apply. If the client exercises the Flex-Forward Income Benefit rider and starts taking Early Income Amount payments before the youngest Covered Person turns 59½, they may be subject to tax penalties. Please be sure to encourage your clients to discuss their situation with a tax advisor prior to exercising their rider.

Interest rates, participation rates, spread rates, caps and strategy fees are subject to change. While the value of each indexed account is affected by the value of an outside index, the contract does not directly participate in any stock, bond or equity investment. Dividend payments and distributions are not received from any index or component of any index. Nassau may change, add or eliminate indexed accounts. Certain accounts may not be available in all states. Although index credits are never less than 0%, it is possible for the contract to lose value if index credits are less than rider and strategy fees. Riders involve an added fee that is deducted from the contract value. Riders as well as terminal illness and nursing home waivers are only available for issue ages 80 and below. Nursing home waiver is not available in CA.

Non-Security Status Disclosure – The Contract is not a Security. The Contract is not registered under the Securities Act of 1933 and is being offered and sold in reliance on an exemption therein.

The “S&P 500 Index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”) and has been licensed for use by Nassau Life and Annuity Company and its affiliates (collectively, “Nassau”). Standard & Poor’s®, S&P 500® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and these trademarks have been licensed and sublicensed for use by SPDJI and Nassau, respectively. Nassau products are not sponsored, endorsed, sold or promoted by SPDJI, S&P, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Nasdaq® is a registered trademark of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Nassau. The Product(s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCT(S).

The Smart Passage SG Index (the “Index”) is the exclusive property of SG Americas Securities, LLC (SG Americas Securities, LLC, together with its affiliates, “SG”). SG has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) (“S&P”) to maintain and calculate the Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “Société Générale Indices”, “SGI”, and “Smart Passage SG Index” (collectively, the “SG Marks”) are trademarks or service marks of SG. SG has licensed use of the SG Marks to Nassau Life and Annuity Company (“NLA”) for use in a fixed indexed annuity offered by NLA (the “Fixed Indexed Annuity”). SG’s sole contractual relationship with NLA is to license the Index and the SG Marks to NLA. None of SG, S&P or other third party licensor (collectively, the “Index Parties”) to SG is acting, or has been authorized to act, as an agent of NLA or has in any way sponsored, promoted, solicited, negotiated, endorsed, offered, sold, issued, supported, structured or priced any Fixed Indexed Annuity or provided investment advice to NLA.

No Index Party has passed on the legality or suitability of, or the accuracy or adequacy of the descriptions and disclosures relating to, the Fixed Indexed Annuity, including those disclosures with respect to the Index. The Index Parties make no representation whatsoever, whether express or implied, as to the advisability of purchasing, selling or holding any product linked to the Index, including the Fixed Indexed Annuity, or the ability of the Index to meet its stated objectives, including meeting its target volatility. The Index Parties have no obligation to, and will not, take the needs of NLA or any annuitant into consideration in determining, composing or calculating the Index. The selection of the Index as a crediting option under a Fixed Indexed Annuity does not obligate NLA or SG to invest annuity payments in the components of the Index.

THE INDEX PARTIES MAKE NO REPRESENTATION OR WARRANTY WHATSOEVER, WHETHER EXPRESS OR IMPLIED, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, THOSE OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE), WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN OR RELATING THERETO, AND IN PARTICULAR DISCLAIM ANY GUARANTEE OR WARRANTY EITHER AS TO THE QUALITY, ACCURACY, TIMELINESS AND/OR COMPLETENESS OF THE INDEX OR ANY DATA INCLUDED THEREIN, THE RESULTS OBTAINED FROM THE USE OF THE INDEX AND/OR THE CALCULATION OR COMPOSITION OF THE INDEX, OR CALCULATIONS MADE WITH RESPECT TO ANY FIXED INDEXED ANNUITY AT ANY PARTICULAR TIME ON ANY PARTICULAR DATE OR OTHERWISE. THE INDEX PARTIES SHALL NOT BE LIABLE (WHETHER IN NEGLIGENCE OR OTHERWISE) TO ANY PERSON FOR ANY ERROR OR OMISSION IN THE INDEX OR IN THE CALCULATION OF THE INDEX, AND THE INDEX PARTIES ARE UNDER NO OBLIGATION TO ADVISE ANY PERSON OF ANY ERROR THEREIN, OR FOR ANY INTERRUPTION IN THE CALCULATION OF THE INDEX. NO INDEX PARTY SHALL HAVE ANY LIABILITY TO ANY PARTY FOR ANY ACT OR FAILURE TO ACT BY THE INDEX PARTIES IN CONNECTION WITH THE DETERMINATION, ADJUSTMENT OR MAINTENANCE OF THE INDEX. WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL AN INDEX PARTY HAVE ANY LIABILITY FOR ANY DIRECT DAMAGES, LOST PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

No Index Party is a fiduciary or agent of any purchaser, seller or holder of a Fixed Indexed Annuity. None of SG, S&P or any third party licensor shall have any liability with respect to the Fixed Indexed Annuity in which an interest crediting option is based is on the Index, nor for any loss relating to the Fixed Indexed Annuity, whether arising directly or indirectly from the use of the Index, its methodology, any SG Mark or otherwise. Obligations to make payments under the Fixed Indexed Annuities are solely the obligation of NLA.

In calculating the performance of the Index, SG deducts a maintenance fee of 0.50% per annum on the level of the Index, and fixed transaction and replication costs, each calculated and deducted on a daily basis. Because the Index can experience potential leverage up to 350%, the maintenance fee may be as high as 1.75% per year. The transaction and replication costs cover, among other things, rebalancing and replication costs. The total amount of transaction and replication costs is not predictable and will depend on a number of factors, including the performance of the index underlying the Index, and market conditions, among other factors. These fees and costs will reduce the potential positive change in the Index and increase the potential negative change in the Index. While the volatility control applied by the Index may result in less fluctuation in rates of return as compared to indices without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls.

The Smart Passage SG Index was launched in 2019. Any index performance shown in illustrations and hypothetical examples for periods prior to the index launch dates is based on historical backcasting using hypothetical data. Past performance is not indicative of future results.

Sunrise Smart Passage SG accounts measure the percentage change in the index after the best monthly return for each year in the segment is set to zero (“Sunrise Adjustment”). The participation rate declared at the segment’s start is then applied to determine the index credit. Higher participation rates are possible due to the Sunrise Adjustment, but this account may under perform other accounts if the growth is concentrated in one or two months.

Nassau Income Accelerator (19FIA, ICC19EIAN, 19ISN, 19GLWB2, 23GLWB2.1, 22GLWB, 22GLWB1.1, ICC22GLWB1.1, ICC23GLWB2.1) is issued by Nassau Life and Annuity Company (Hartford, CT). In California, Nassau Life and Annuity Company does business as “Nassau Life and Annuity Insurance Company.” Nassau Life and Annuity Company is not authorized to conduct business in ME and NY, but that is subject to change. Nassau Life and Annuity Company is a subsidiary of Nassau Financial Group.

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee

Nassau Income Accelerator is an insurance contract, not an investment; it doesn't provide ownership of any stocks, bonds, index funds, or other securities.

The LifeYield name/logo and Social Security+ are trademarks of LifeYield, LLC ("LifeYield"). LifeYield is an independent company/entity and not an affiliate of Nassau.

FOR PRODUCER USE ONLY

BPD41512

2-26